The Complete Guide to Value Investing: A 2025 Framework

The core objective is to identify wonderful companies and then wait with the patience of a predator for the market's inevitable irrationality to offer them at a discount. This discount is the "margin of safety"—the foundational concept that protects investors from permanent capital loss.

This guide provides a definitive, step-by-step framework for implementing this powerful philosophy in today's market. We will move beyond the theory and give you the actionable process needed to analyze companies, value them accurately, and construct a portfolio designed to compound wealth over the long term.

The Three Pillars of the Value Investing Mindset

Before analyzing a single financial statement, one must adopt the proper mindset. The market is a battlefield of emotions—fear, greed, euphoria, and panic. Without a strong intellectual and psychological foundation, you are destined to become a casualty of its mood swings. Value investing is built upon three pillars that insulate you from this chaos.

Pillar 1: Operate Within Your Circle of Competence

"Know your circle of competence, and stick within it. The size of that circle is not very important; knowing its boundaries, however, is vital." - Warren Buffett

You do not need to be an expert in biotechnology, enterprise software, and international shipping to be a successful investor. In fact, trying to be one is a surefire path to mediocrity. A circle of competence is the set of industries and business models that you can understand with deep, almost intuitive clarity.

Within this circle, you can confidently:

- Assess the company's long-term competitive position.

- Reasonably forecast future earnings and cash flows.

- Identify the key variables that drive success or failure.

- Understand the products, customers, and regulatory landscape.

If you cannot explain how a business makes money and why it will continue to do so in ten years, it is outside your circle. Forcing an investment in a company you don't understand is pure speculation. The intelligent investor patiently waits for opportunities to arise within the boundaries of their knowledge.

Pillar 2: Heed the Parable of Mr. Market

Benjamin Graham, in his seminal book The Intelligent Investor, introduced the allegory of "Mr. Market" to personify the irrationality of the stock market. Imagine you are partners in a business with a man named Mr. Market. Every day, he comes to you and offers to either sell you his shares or buy yours at a specific price.

- Some days, he is euphoric, caught up in good news, and quotes a ridiculously high price.

- On other days, he is despondent, panicked by headlines, and offers to sell you his stake for pennies on the dollar.

Mr. Market is there to serve you, not to guide you. His daily quotes are not a measure of the business's true value; they are a measure of his emotional state. The value investor is free to ignore him on most days, but on the days his pessimism creates an opportunity, they act decisively. They buy when he is fearful and consider selling when he is greedy.

Pillar 3: Adopt a Business Ownership Mentality

A stock certificate represents a legal claim on a proportion of a company's assets and earnings. You are not buying a ticker; you are buying a piece of a business. This is the most crucial mental shift an investor can make.

Before any purchase, you should apply the "private buyer test":

- Would I be comfortable owning this entire business if the stock market closed for the next five years?

- Do I have a clear understanding of its revenue streams, cost structure, and profit margins?

- Do I trust the management team to act as prudent stewards of my capital?

This mentality forces you to focus on the underlying fundamentals—the engine of long-term value creation - rather than the distracting noise of daily price movements.

The Quantitative Core: Calculating Intrinsic Value

Intrinsic value is the single most important concept in value investing. It is an estimate of a business's true underlying worth, based on its ability to generate cash for its owners over its remaining life. This value is entirely independent of the stock price. The price is what you pay; the value is what you get. The entire game is to consistently buy for less than you get.

While there are many ways to estimate intrinsic value, the most intellectually honest method is a Discounted Cash Flow (DCF) analysis.

A Step-by-Step Guide to DCF Analysis

A DCF model is built on the simple premise that an asset's worth is the sum of all the cash it will generate in the future, discounted back to today's dollars. This is because a dollar tomorrow is worth less than a dollar today.

Here is a simplified, two-stage DCF process:

Step 1: Project Future Free Cash Flow (FCF)

Free Cash Flow is the cash left over after a company has paid its expenses and funded its investments in inventory and equipment. It's the cash available to be returned to investors. You must project this figure for a forecast period, typically 5 to 10 years. This requires a deep dive into the company's 10-K filings to make educated assumptions about:

- Revenue Growth: Based on historical performance, industry trends, and competitive advantages.

- Profit Margins: Will they expand, contract, or remain stable?

- Capital Expenditures (CapEx): How much must the company reinvest to maintain and grow its operations?

Step 2: Determine a Discount Rate (r)

The discount rate reflects the riskiness of the investment. A common choice is the Weighted Average Cost of Capital (WACC), which blends the cost of the company's debt and equity. A higher discount rate (for a riskier business) will result in a lower present value.

Step 3: Calculate the Terminal Value

You cannot project cash flows forever. The terminal value represents the value of the business for all the years beyond your forecast period. A common method is the perpetuity growth model:

The perpetual growth rate is the rate at which you expect the company's cash flows to grow forever, which should not exceed the long-term rate of economic growth (e.g., 2-3%).

Step 4: Discount All Cash Flows to the Present

Finally, you discount the projected FCF for each year and the terminal value back to today to arrive at the total intrinsic value.

While a DCF is precise, it is not always accurate. The output is highly sensitive to your assumptions. Therefore, intelligent investors use conservative assumptions and triangulate their DCF valuation with other, simpler metrics (like P/E, P/B, EV/EBITDA) to establish a reasonable range of value.

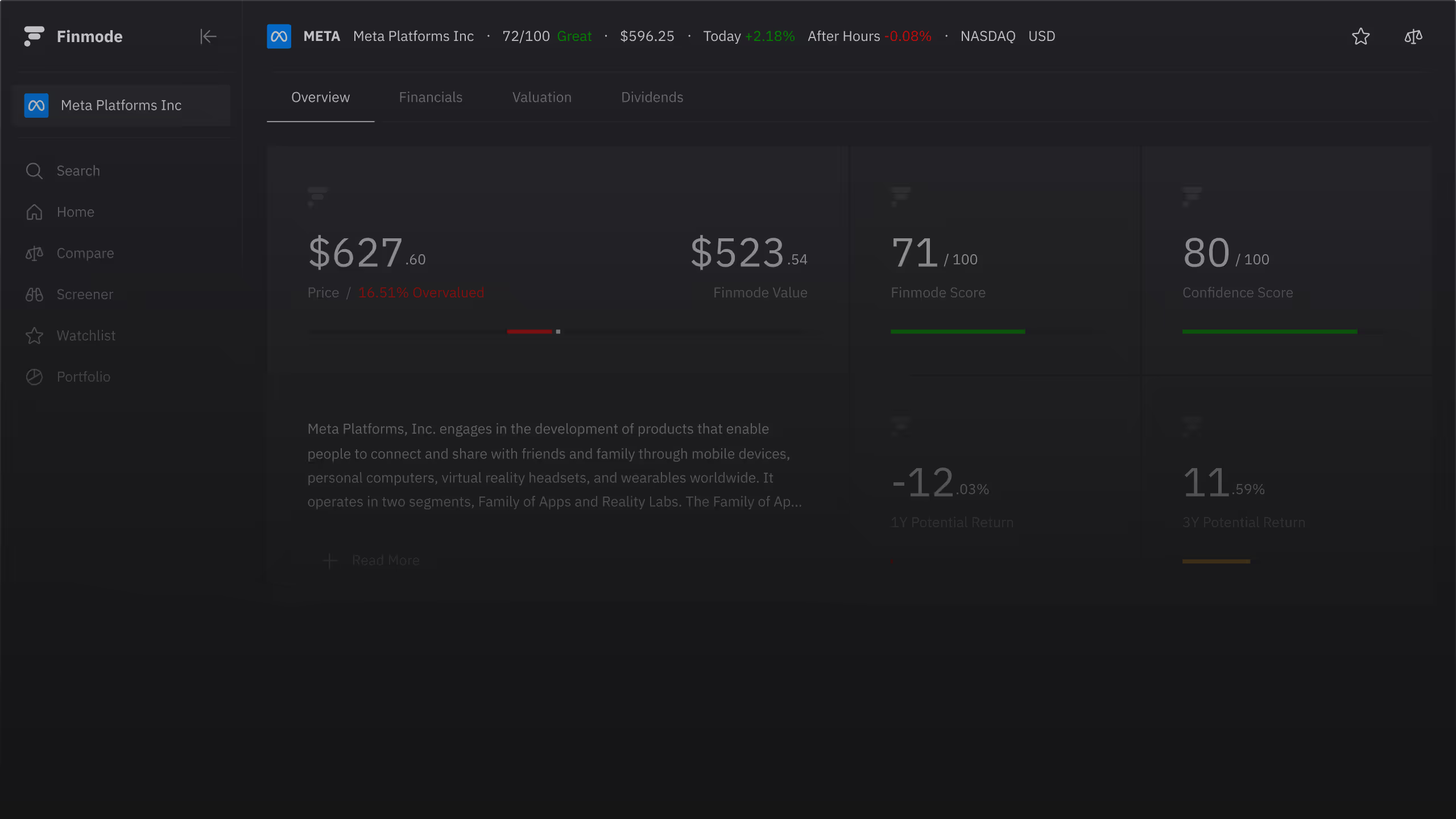

Finmode Scores are calculated based on numerous financial and business metrics including DCF to determine the health of a company and its ability to generate cash in the future.

The Defensive Core: Demanding a Margin of Safety

"The three most important words in investing are margin of safety." - Benjamin Graham

The margin of safety is the bedrock principle of risk management in value investing. It is the discount between the calculated intrinsic value of a business and the price you pay for its stock.

If your analysis suggests a company is worth $100 per share and it's trading at $60, you have a 40% margin of safety. This discount provides a crucial buffer against the uncertainties of the future:

- Valuation Errors: Your DCF model might be too optimistic.

- Economic Headwinds: An unexpected recession could impact earnings.

- Company-Specific Setbacks: A new competitor emerges or a product launch fails.

A large margin of safety means you don't need to be perfect to earn a satisfactory return. The size of the margin you demand should vary based on the quality and predictability of the business. For a stable, wide-moat company like Johnson & Johnson, a 25-30% margin might suffice. For a more cyclical or speculative business, you might demand a 50% or greater discount. This discipline is the single greatest determinant of your long-term returns.

The Strategic Core: Identifying Durable Economic Moats

An economic moat is a durable competitive advantage that protects a business's profits from competitors, much like a real moat protects a castle. A company with a wide moat can sustain high returns on invested capital for decades. Identifying these structural advantages is the key to separating wonderful businesses from mediocre ones.

There are five primary sources of economic moats, as popularized by Morningstar:

A business without a moat is at the mercy of competition. A business with a moat is the master of its own destiny. Your job as an investor is to find the latter at a price that doesn't reflect that powerful advantage.

The 2025 Value Investing Workflow: A 5-Step Process

Theory is essential, but execution is what matters. Here is a practical, repeatable workflow for applying these principles to find undervalued stocks in today's market.

Step 1: Idea Generation & Screening

The investment universe is vast. You need a systematic way to filter it down to a manageable list of potential candidates. This is where a powerful stock screener is indispensable. You can build screens based on key value metrics:

- Price-to-Earnings (P/E) < 15

- Price-to-Book (P/B) < 1.5

- Price-to-Free-Cash-Flow (P/FCF) < 15

- Debt-to-Equity < 0.5

- Return on Invested Capital (ROIC) > 12%

This quantitative screen is just a starting point. It provides a fertile hunting ground, not a list of stocks to buy blindly. You can use our Finmode Screener to quickly filter through 10,500+ stocks and find market opportunities at lightning speed.

Step 2: Deep Dive into Financial Statements

This is where the real analytical work begins. For each company on your list, you must conduct a thorough review of at least a decade's worth of financial statements (10-Ks and 10-Qs).

- Income Statement: Is revenue growing consistently? Are profit margins stable or expanding? Are there any one-time charges that distort earnings?

- Balance Sheet: How much debt is the company carrying? Is the book value growing? How much cash does it have on hand?

- Cash Flow Statement: This is often the most important statement. Is the company generating consistent cash from operations? How is it deploying that cash (acquisitions, dividends, share buybacks)? A company that reports high net income but low free cash flow is a major red flag.

Step 3: Qualitative Analysis (Moat & Management)

Once you understand the numbers, you must understand the business behind them.

- Assess the Moat: Does the company have a durable competitive advantage from one of the five sources listed above? How is that moat trending—is it getting stronger or weaker?

- Evaluate Management: Read the CEO's annual shareholder letters. Are they candid and transparent? Are their compensation incentives aligned with long-term shareholder value? Do they have a track record of intelligent capital allocation?

Step 4: Valuation and Margin of Safety

With a deep understanding of the business, you can now build your valuation model.

- Primary Valuation: Construct a conservative DCF model to estimate intrinsic value.

- Sanity Checks: Compare your DCF output to simpler metrics. What is the company's historical P/E ratio? How does it compare to its closest competitors?

- Calculate Your Buy Price: Determine the margin of safety you require. If your intrinsic value estimate is $200 and you require a 40% margin of safety, your buy price is $120.

Step 5: Patience and Action

If the stock is trading at or below your buy price, you act. If not, you add it to a watchlist and wait patiently. The market will eventually offer you a price you like. Investing is a game where the player who can sit still the longest often wins.

Conclusion: The Enduring Advantage of a Disciplined Framework

Value investing is simple, but it is not easy. It requires discipline, patience, and an unwavering focus on business fundamentals in a world obsessed with short-term noise. The principles outlined by Benjamin Graham over 75 years ago remain the most reliable path to long-term wealth creation because they are based on the timeless logic of business ownership.

Successfully executing this strategy in 2025 demands more than just philosophy; it requires powerful, modern tools. The ability to screen thousands of stocks on complex criteria, access pristine historical financial data, and model future cash flows efficiently is what separates the amateur from the professional.

The FinMode terminal was built for this exact purpose. It is a professional-grade research platform designed to empower the serious value investor to apply this framework with speed and precision.

Start making investment decisions based on value, not volatility. Begin your analysis with Finmode today - get started free.

Read more insights

Intrinsic Value Calculation: A Step-by-Step Guide for 2025

Margin of Safety: The Value Investor's Ultimate Protection

Try Finmode Today

Free To Get Started